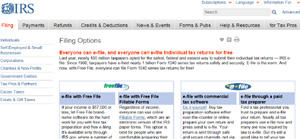

As the deadline for companies to mail out W2 tax forms by the end of January approaches, millions of Americans, especially those filing taxes for the first time, are looking for ways to file taxes online for free. The IRS freefile, a free online tax filing service, may be the perfect solution.

As the deadline for companies to mail out W2 tax forms by the end of January approaches, millions of Americans, especially those filing taxes for the first time, are looking for ways to file taxes online for free. The IRS freefile, a free online tax filing service, may be the perfect solution.

According to the IRS.gov web site, approximately 70% of American taxpayers have an adjusted gross income (AGI) of $57,000 or less. For these taxpayers, the IRS freefile program provides a way to file their income taxes online for free, and if they have overpaid, receive a speedy tax refund.

For those who may not qualify for the IRS.gov freefile program, there are still a number of free online tax filing services which are not based on your income or AGI. Online tax filing services like Turbotax base their fees for filing on the type of tax return. For the millions of Americans who file using a simple 1040EZ for 1040 tax form, it is free to file your Federal income taxes using their service. The program uses a step-by-step approach to tax filing asking questions in plain English, making tax filing, and hopefully getting a tax refund, very easy.

For taxpayers with more complex tax situations, or who also have a side business, Turbotax and other online tax programs also have tax filing options which are inexpensive yet very thorough.

What are the benefits of filing taxes online? Filing income taxes online, known as e-file, can help speed the delivery of any tax refund due. According to the IRS, taxpayers choosing an e-file option can check on the status of their tax refund typically within 72 hours of submitting their e-file online tax return.

![Herbal Reference Substances are Key to Everyday Products <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/herbal-reference-substances-are-key-to-everyday-products/3512112/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>When it comes to quality control testing and the development of new products, Botanical Reference Materials (BRMs), also known as Herbal References are critically important. To help companies ultimately obtain all-important FDA approval, the Food and Drug Administration provides in its guidance a recommendation that […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/herbal-reference-substances-are-key-to-everyday-products/3512112/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2021/02/Achillea_millefolium_flowers-100x100.jpg)

![Quality Electrochemical Biosensors are Critical for Medical, Food and Chemical Industry <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/quality-electrochemical-biosensors-are-critical-for-medical-food-and-chemical-industry/3512086/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>A number of industries have, at their core, a need to frequent or even continuous analysis of biological media. These include the medical and pharmaceutical fields, biotech firms, and food and chemical companies. To maintain quality standards and develop new products, these industries rely heavily […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/quality-electrochemical-biosensors-are-critical-for-medical-food-and-chemical-industry/3512086/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2020/10/Electrochemical-Biosensor-100x100.jpg)

![Company Develops Industrial Mixers Well-Suited for both Fragile and Explosive Products <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/company-develops-industrial-mixers-well-suited-for-both-fragile-and-explosive-products/3512071/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>Industrial drum mixers are normally applied to blend mixes of varying viscosities such as adhesive slurries or cement. Some of these mixers have the capability of blending mixes of very different particle sizes such as fruit and ice cream, and gravel and cement slurry. The […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/company-develops-industrial-mixers-well-suited-for-both-fragile-and-explosive-products/3512071/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2020/06/bandeau-sofragir2-100x100.jpg)