As the price of oil continues to fall, what seems like good news for consumers is having a devastating effect on the price of energy stocks down and much of the stock market overall.

As the price of oil continues to fall, what seems like good news for consumers is having a devastating effect on the price of energy stocks down and much of the stock market overall.

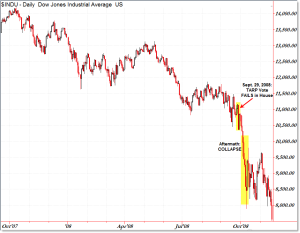

Financial experts such as Harry Dent and Robert Shiller say the U.S. stock market is overdue for a correction. Shiller recently noted in Forbes that the market is 65 percent overvalued, mainly fueled by “irrational exuberance.”

For those concerned about where the future of the market is headed, and how to avoid potential financial disaster, the two are providing 4 helpful tips and advice to hopefully safe in the next major downturn.

A growing trend among those seeking to beat the bear is to channel investments into real estate, he says. Not the kind of venture that turned many into reluctant landlords during the housing bust, but another type called hard money lending.

“Here’s how it works,” Buscemi says. “Investors act like a bank and make short-term loans to small businesses that buy and repair distressed properties, refinance them with conventional bank loans and repay the short-term loans at higher interest rates, generating more profitable returns for the original lenders.”

Here are Buscemi recommendations to get the most out of this lucrative venture:

1. Shop local. All things being equal, private investors are often served by small, perhaps localized real estate private partnerships that throw off real cash flow than by global, publicly listed full-service investment brands where an alignment of interest between investors and these corporations may be deficient or missing.

2. Explore crowd funding. With the advent of crowd funding and federal rule changes since the last real estate cycle, more people with less money can participate in deals that they may have never been able to get into before.

3. Have a pre-flight checklist. The best time to worry about a real estate loan is before you make it. Always have a list of items to review before committing capital. These include job history, experience in rehab property, education, and most important, credit quality. Always read the entire credit report as the devil is in the details. Also make sure to accept reports from a third party, not the borrower as they can be faked.

4. Always ask how your interests are aligned with your borrowers. If they are not going to make any money, neither will you. The loan will default, and you’ll both be discouraged.

“Individual investors are looking for a more intimate method of managing their own money, insulated from geopolitical shocks,” Mr. Buscemi says. “They don’t want to wake up in the morning blindsided that they’ve lost a good chunk of their portfolio because of something that happened overseas. Real estate keeps climbing higher and higher in some markets. And people implicitly trust real estate; it’s a very bankable asset class.”

![Herbal Reference Substances are Key to Everyday Products <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/herbal-reference-substances-are-key-to-everyday-products/3512112/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>When it comes to quality control testing and the development of new products, Botanical Reference Materials (BRMs), also known as Herbal References are critically important. To help companies ultimately obtain all-important FDA approval, the Food and Drug Administration provides in its guidance a recommendation that […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/herbal-reference-substances-are-key-to-everyday-products/3512112/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2021/02/Achillea_millefolium_flowers-100x100.jpg)

![Quality Electrochemical Biosensors are Critical for Medical, Food and Chemical Industry <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/quality-electrochemical-biosensors-are-critical-for-medical-food-and-chemical-industry/3512086/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>A number of industries have, at their core, a need to frequent or even continuous analysis of biological media. These include the medical and pharmaceutical fields, biotech firms, and food and chemical companies. To maintain quality standards and develop new products, these industries rely heavily […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/quality-electrochemical-biosensors-are-critical-for-medical-food-and-chemical-industry/3512086/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2020/10/Electrochemical-Biosensor-100x100.jpg)

![Company Develops Industrial Mixers Well-Suited for both Fragile and Explosive Products <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/company-develops-industrial-mixers-well-suited-for-both-fragile-and-explosive-products/3512071/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>Industrial drum mixers are normally applied to blend mixes of varying viscosities such as adhesive slurries or cement. Some of these mixers have the capability of blending mixes of very different particle sizes such as fruit and ice cream, and gravel and cement slurry. The […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/company-develops-industrial-mixers-well-suited-for-both-fragile-and-explosive-products/3512071/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2020/06/bandeau-sofragir2-100x100.jpg)