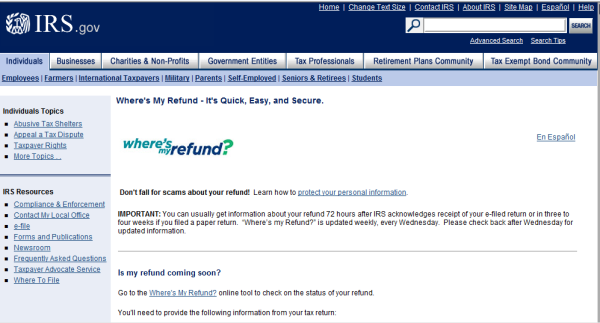

As millions of Americans file their taxes online, in person or by mail, the number one question is often “Where’s My Refund.” To answer that question, the IRS actually has a ‘Wheres My Refund’ calculator tool to give tax filers an estimate on how long they can expect to wait to get their income tax refund.

As millions of Americans file their taxes online, in person or by mail, the number one question is often “Where’s My Refund.” To answer that question, the IRS actually has a ‘Wheres My Refund’ calculator tool to give tax filers an estimate on how long they can expect to wait to get their income tax refund.

Typically, the IRS estimate is only about 10 days if you elect to receive your tax refund through direct deposit to your bank account. The refund time is also sped up by using many of the free online tax filing services like TurboTax, H&R Block online, and even the IRS.gov ‘Free File’ option on the IRS.gov web site.

Currently, however, the ‘where’s my refund’ calculations have not been accurate. Currently many are receiving their refunds about a week later than the Where’s My Refund tool estimated.

According to the IRS, the issue “relates to fine-tuning IRS systems to adjust for new safeguards put in place this tax season to provide stronger protection against refund fraud.”

While the technical glitch in the system was to have been fixed by now, there are still some issues with consistency of the estimates being reported. Experts in the industry indicate that the issue stems from the integration between the old systems at the IRS and new systems which allow for the e-file with the IRS.

The IRS posted the following message on the ‘Where’s My Refund’ section of the IRS.gov web site:

“Update: We are aware that some taxpayers who have filed electronically and received an acknowledgement from the IRS are concerned when they visit “Where’s My Refund” and are told that we have no information regarding their return. This is a temporary situation, and we expect to resolve the matter in a few days. At that time, taxpayers will be able to get an expected refund date when they visit “Where’s My Refund.”

“If a taxpayer received an acknowledgment message that their e-filed tax return has been received, they can be assured that the IRS has the tax return even though “Where’s My Refund” does not reflect that. Taxpayers should not call the IRS unless specifically directed by “Where’s My Refund,” as there is no new information to give them.

“We expect the vast majority of tax refunds to continue to be issued within the historical range of 10 to 21 days. The IRS is taking steps to update information so that Where’s My Refund has current information. The IRS apologizes for any inconvenience and will provide updated information as soon as possible.”

![Herbal Reference Substances are Key to Everyday Products <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/herbal-reference-substances-are-key-to-everyday-products/3512112/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>When it comes to quality control testing and the development of new products, Botanical Reference Materials (BRMs), also known as Herbal References are critically important. To help companies ultimately obtain all-important FDA approval, the Food and Drug Administration provides in its guidance a recommendation that […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/herbal-reference-substances-are-key-to-everyday-products/3512112/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2021/02/Achillea_millefolium_flowers-100x100.jpg)

![Quality Electrochemical Biosensors are Critical for Medical, Food and Chemical Industry <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/quality-electrochemical-biosensors-are-critical-for-medical-food-and-chemical-industry/3512086/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>A number of industries have, at their core, a need to frequent or even continuous analysis of biological media. These include the medical and pharmaceutical fields, biotech firms, and food and chemical companies. To maintain quality standards and develop new products, these industries rely heavily […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/quality-electrochemical-biosensors-are-critical-for-medical-food-and-chemical-industry/3512086/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2020/10/Electrochemical-Biosensor-100x100.jpg)

![Company Develops Industrial Mixers Well-Suited for both Fragile and Explosive Products <!-- AddThis Sharing Buttons above -->

<div class="addthis_toolbox addthis_default_style " addthis:url='http://newstaar.com/company-develops-industrial-mixers-well-suited-for-both-fragile-and-explosive-products/3512071/' >

<a class="addthis_button_facebook_like" fb:like:layout="button_count"></a>

<a class="addthis_button_tweet"></a>

<a class="addthis_button_pinterest_pinit"></a>

<a class="addthis_counter addthis_pill_style"></a>

</div>Industrial drum mixers are normally applied to blend mixes of varying viscosities such as adhesive slurries or cement. Some of these mixers have the capability of blending mixes of very different particle sizes such as fruit and ice cream, and gravel and cement slurry. The […]<!-- AddThis Sharing Buttons below -->

<div class="addthis_toolbox addthis_default_style addthis_32x32_style" addthis:url='http://newstaar.com/company-develops-industrial-mixers-well-suited-for-both-fragile-and-explosive-products/3512071/' >

<a class="addthis_button_preferred_1"></a>

<a class="addthis_button_preferred_2"></a>

<a class="addthis_button_preferred_3"></a>

<a class="addthis_button_preferred_4"></a>

<a class="addthis_button_compact"></a>

<a class="addthis_counter addthis_bubble_style"></a>

</div>](http://newstaar.com/wp-content/uploads/2020/06/bandeau-sofragir2-100x100.jpg)